Why the Federal Reserve Can’t—and Won’t—Hold Bitcoin Anytime Soon

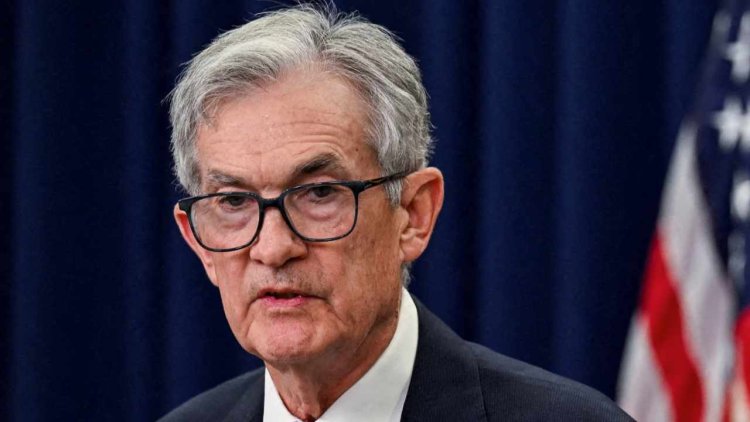

Federal Reserve Chair Jerome Powell dismisses the possibility of the Fed holding Bitcoin, citing legal restrictions and a cautious stance on cryptocurrencies. Learn more about the implications for U.S. crypto policy.

The Federal Reserve has once again ruled out the possibility of holding Bitcoin in its reserves. Federal Reserve Chair Jerome Powell emphasized this during a recent press conference, following the announcement of an interest rate cut. When asked about the potential for the U.S. government to establish a Bitcoin reserve, Powell dismissed the idea, citing legal and regulatory constraints. He stated:

“We’re not allowed to own Bitcoin. The Federal Reserve Act says what we can own, and we’re not looking for a law change. That’s the kind of thing for Congress to consider, but we are not looking for a law change at the Fed.”

Powell’s remarks align with his historically cautious stance on cryptocurrencies. He has consistently characterized Bitcoin as a speculative asset, unsuited for use as a stable currency. In 2021, Powell remarked that cryptocurrencies are “not really useful as a store of value” due to their volatility. This instability, he argued, poses risks to investors and financial systems. Powell has also differentiated between decentralized cryptocurrencies like Bitcoin and central bank digital currencies (CBDCs), highlighting the latter as safer and more controlled innovations.

Legal and Structural Constraints

Under the Federal Reserve Act, the central bank’s asset holdings are limited to U.S. government bonds and other highly secure assets. Despite the Fed’s expanded asset purchases during economic crises such as the 2008 financial crash, cryptocurrencies remain outside its legal purview. While legislative efforts, like Senator Cynthia Lummis’ proposed Bitcoin Act, have aimed to integrate Bitcoin into the U.S. financial system, they face significant resistance. Many lawmakers express concerns over cryptocurrency’s lack of regulation and its potential misuse in illicit activities.

Shifting Market Dynamics

Meanwhile, recent political developments have added complexity to the U.S. crypto landscape. Notably, former President Donald Trump announced plans to establish a national Bitcoin reserve, positioning the U.S. as a leader in cryptocurrency adoption. This proposal includes acquiring substantial Bitcoin holdings, potentially utilizing assets seized in criminal cases as a foundation.

The market’s response to these developments has been significant. Bitcoin’s value recently surpassed $100,000, reflecting investor optimism about favorable regulatory changes under the forthcoming administration. Trump’s appointment of David Sacks as the White House AI and Crypto Czar further underscores the growing focus on digital assets in national economic strategy.

The Road Ahead

Despite these shifts, the Federal Reserve’s stance on Bitcoin remains firmly conservative. Powell’s comments suggest that any integration of cryptocurrencies into federal policy will require Congressional action and significant regulatory adjustments. As the U.S. navigates the evolving crypto landscape, the Federal Reserve’s cautious approach highlights the broader challenges of balancing innovation with financial stability.

What's Your Reaction?