Bollinger Bands Predict Bitcoin’s Upcoming Surge – What’s the Next Peak?

Bitcoin (BTC) may soon experience a significant price surge, breaking key levels according to Bollinger Bands analysis. Experts predict ambitious targets for 2025.

Bollinger Bands Predict Bitcoin’s Upcoming Surge – What’s the Next Peak?

Bitcoin (BTC) is poised for a potential price surge as it tests key levels, according to the classic Bollinger Bands technical indicator.

In a post on X (formerly Twitter) dated December 18, John Bollinger, the creator of the Bollinger Bands, highlighted Bitcoin’s promising position for an upward breakout.

Bitcoin and Bollinger Bands: The Climb Ahead

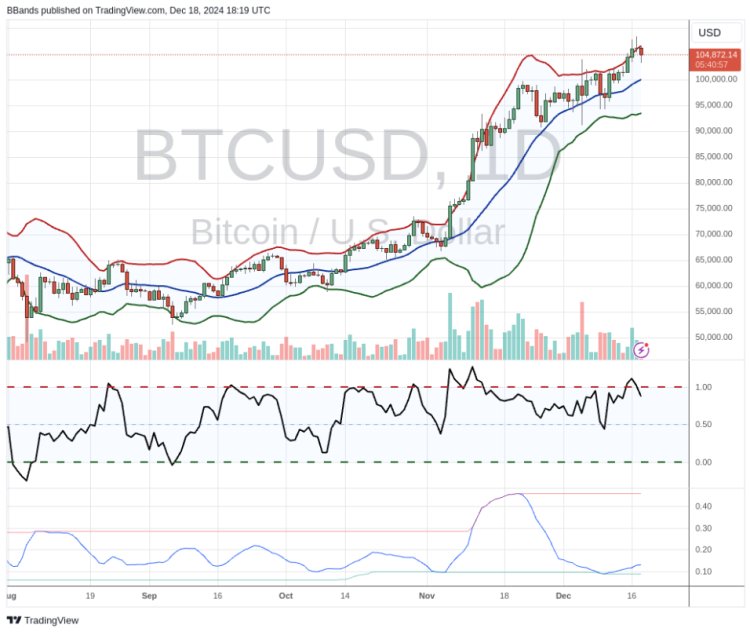

After hitting an all-time high of over $108,000 on December 17, Bitcoin breached the upper band of the Bollinger Bands (BB), a threshold it hadn’t crossed since mid-November, according to TradingView data.

This development is a positive signal, per Bollinger’s analysis. The Bollinger Bands measure price volatility by using standard deviations around a simple moving average to indicate potential price ranges and fluctuations.

Over the past days, the BTC/USD pair has recorded daily candles touching the upper band of the BB. Historically, this indicates two scenarios:

- A price retraction back to the middle band.

- A strong price surge.

The recent movement suggests the second scenario is more likely as Bitcoin’s action has pushed the upper band higher.

“BTC/USD is delivering a live lesson on Bollinger Bands,” Bollinger commented, sharing a chart.

Key Observation

A classic Bollinger Bands squeeze phenomenon often leads to price “riding” the upper band upward, paving the way for further gains.

Bitcoin’s Next Price Peaks: Predictions for 2025 and Beyond

Bitcoin’s recent rally has led to ambitious price targets for 2025 and the long term.

Bitcoin at $350,000 in 2025

Mauricio Di Bartolomeo, co-founder of Ledn, envisions Bitcoin outpacing gold in value, ultimately reaching equivalence with 50 ounces of gold per BTC.

“I believe Bitcoin will continue gaining value against gold, reaching parity with 50 ounces,” Bartolomeo wrote in a December 19 article on Forbes.

At current gold prices, this parity equates to approximately $132,500 per Bitcoin.

Bartolomeo also predicts growing institutional recommendations for portfolio allocations into Bitcoin, spurred by ETFs and advisory reports.

Higher Predictions: $350K to $1 Million

Robert Kiyosaki, a vocal Bitcoin supporter since 2017, offered an even bolder forecast. In a December 18 post on X, he predicted Bitcoin could reach $350,000 by 2025.

Other forecasts include:

- Perianne Boring, founder of The Digital Chamber, predicts a potential surge to $800,000 based on the stock-to-flow model.

- PlanB, the creator of the stock-to-flow model, estimates Bitcoin’s average price in 2025 will hover around $500,000, with a peak reaching as high as $1 million.

Conclusion: Bitcoin’s Path Ahead

With key technical indicators signaling a possible surge and ambitious forecasts from market leaders, Bitcoin continues to be a focal point for investors eyeing 2025.

Disclaimer: This article is for informational purposes only and not investment advice. Investors should conduct thorough research before making any financial decisions. We are not responsible for investment outcomes.

What's Your Reaction?