US Dollar Forecast: USD/JPY Rallies Ahead of US CPI Report

USD/JPY rallies to a fresh monthly high as markets anticipate US CPI data. Explore key levels and potential impacts of persistent inflation on the US Dollar.

US Dollar Forecast: USD/JPY Rallies Ahead of US CPI Report

The USD/JPY surged to a fresh monthly high of 152.18 ahead of the highly anticipated update to the US Consumer Price Index (CPI). This rally reflects the exchange rate’s break above the December opening range, hinting at continued upward momentum as the week unfolds.

Currency Overview

The USD/JPY has been carving out a bullish pattern, reaching a series of higher highs and lows. This upward trend persists despite a muted market reaction to the recent US Non-Farm Payrolls (NFP) report, which showed a 227,000 increase in jobs. As the Federal Reserve maintains its neutral monetary stance, the pair remains closely aligned with movements in US Treasury yields.

Focus on US CPI Data

The US CPI report is expected to show an increase in annual inflation to 2.7% in November, up from 2.6% in October. Meanwhile, core inflation is projected to remain steady at 3.3%. Persistently high inflation figures could bolster the US Dollar as they may pressure the Federal Reserve to delay or slow the pace of policy easing. Conversely, a softer-than-expected CPI reading could dampen USD strength, sparking speculation about potential rate cuts.

Technical Analysis

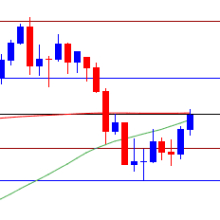

The USD/JPY attempts to reclaim its position above the 50-Day Simple Moving Average (SMA) of 151.66, suggesting that the bullish trajectory may extend. Key resistance levels include:

-

153.80 (23.6% Fibonacci retracement)

-

156.50 (78.6% Fibonacci extension)

A breach of the November high at 156.75 would bring the long-term target of 160.40 (1990 high) into focus. However, failure to maintain higher highs could lead to a reversal, with support zones identified at:

-

148.70 (38.2% Fibonacci retracement)

-

145.90 (50% Fibonacci extension)

A daily close below 148.70 could signal a deeper correction, targeting the October low of 142.97.

Broader Market Implications

Shifts in carry trade dynamics and central bank policies remain critical in shaping the USD/JPY’s trajectory. Market participants are closely monitoring developments in long-term US Treasury yields, alongside updates from major central banks, to gauge the pair’s next move.

What's Your Reaction?