Japanese Yen Short-Term Outlook: USD/JPY Recovery at Key Resistance

Discover the latest USD/JPY technical outlook as the pair rebounds to test key resistance. Explore critical support and resistance levels with actionable insights for December trading.

Japanese Yen Short-Term Outlook: USD/JPY Recovery at Key Resistance

The US Dollar has rebounded against the Japanese Yen, testing significant resistance within the ongoing downtrend. With major US inflation data scheduled for release, USD/JPY sits at a critical juncture. Let’s break down the latest technical levels and trade insights.

Author: Michael Boutros, Sr. Technical Strategist

Date: December 11, 2024

Key Highlights:

- USD/JPY rebounds from key support to test critical resistance at the November downtrend.

- Resistance Levels: 151.74/99 (key), 153.02/40, 154.34.

- Support Levels: 148.73-149.60 (key), 146.14/65, 144.17/63.

- Outlook: Risk of price exhaustion or inflection near resistance.

Technical Analysis Overview:

Daily Chart Insights

The USD/JPY pair bounced more than 2.1% off its monthly low, entering December on a recovery path. Price action now tests the confluence of significant resistance at 151.74/99. This zone is defined by:

- The 38.2% Fibonacci retracement of the November decline.

- The 2022 and 2023 highs.

- The 200-day moving average.

A decisive reaction at this level will be crucial to determining the pair's next direction.

240-Minute Chart Insights

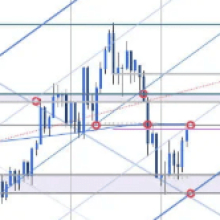

Zooming in, USD/JPY trades within a descending pitchfork pattern originating from the November highs. The upper boundary aligns with the 151.74/99 resistance zone, emphasizing its importance.

A break above this region would target:

- 153.02/40: May low-day close and 61.8% retracement.

- 154.34: November high-day reversal close.

However, failure to clear resistance may see the pair revisit support zones, including:

- 148.73-149.60: Weekly high closes from 2022/2023.

- 146.14/65: Median-line target.

- 144.17/63: August low and January close levels.

Bottom Line:

USD/JPY starts December with a strong rebound but now faces a critical resistance hurdle. A breakout of the 149.60–151.99 range will likely set the tone for near-term price action. Stay cautious ahead of tomorrow's key US inflation data, which may provide additional volatility.

For a comprehensive look at longer-term trends, review our latest Japanese Yen Weekly Forecast.

Key Economic Events to Watch:

| Date | Event | Impact on USD/JPY |

|---|---|---|

| December 12 | US Consumer Price Index (CPI) | High |

| December 13 | BOJ Governor Speech | Medium |

Related Articles:

What's Your Reaction?